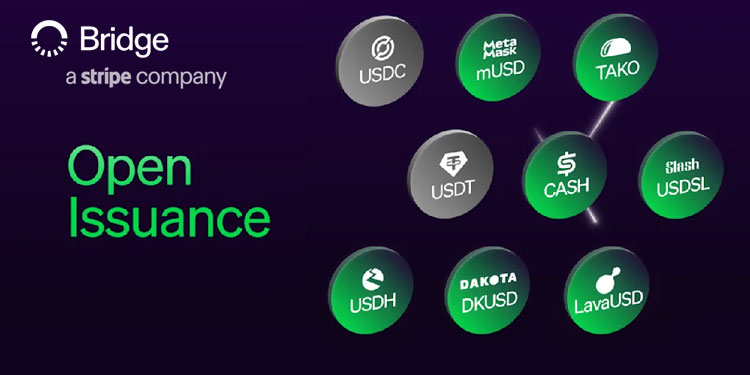

Stripe has introduced a new platform called Open Issuance, designed to simplify the creation of dollar-pegged stablecoins by companies across industries. The initiative seeks to broaden participation in the stablecoin ecosystem by offering technology, token management, and compliance support, placing Stripe in direct competition with established issuers such as Tether and Circle’s USDC.

The move signals a significant change in the $231 billion stablecoin market, as it allows businesses to issue their own branded tokens without requiring specialized technical infrastructure. By offering a streamlined model, Stripe aims to encourage Fortune 500 firms and other major corporations to explore digital currencies as part of their financial operations.

Bridge acquisition underpins launch

Open Issuance is built on the technology of Bridge, a stablecoin infrastructure firm acquired by Stripe for $1.1 billion in October 2024. The platform handles the complex regulatory and technical requirements that have traditionally restricted stablecoin issuance to a handful of crypto-native firms. Analysts suggested that Stripe was effectively converting stablecoin creation into a service model, in the same way that cloud computing simplified software deployment.

The timing of the launch is seen as strategic. In 2024, Stripe processed $1.4 trillion in payments, equal to 1.3% of global GDP. The company has been steadily re-establishing its position in cryptocurrency services after discontinuing Bitcoin payments in 2018 due to scalability issues.

Comprehensive token management features

Open Issuance offers companies a full suite of tools for reserve backing, compliance monitoring, and redemption processes. Businesses can also customize features for their tokens, including programmable spending limits and automated treasury functions. Observers emphasized that the reserve management component of the platform mirrors bank-level custody and compliance, an infrastructure many firms would otherwise struggle to build internally.

Several large corporations are already piloting the service, with reports indicating that Fortune 500 companies are exploring stablecoin applications for treasury operations. The platform integrates with multiple blockchain networks, including Ethereum, Solana, and Polygon, aligning with Stripe’s broader crypto settlement capabilities.

Strategic shift towards tokenized finance

The launch of Open Issuance positions Stripe not only against traditional payment processors such as Visa and Mastercard but also against specialized stablecoin providers. Company leadership has repeatedly highlighted stablecoins as a key driver of future financial systems, comparing their significance to historic shifts from gold-backed to fiat currencies.

— Stripe (@stripe) September 30, 2025

Stripe’s approach to digital assets has accelerated since its re-entry into crypto markets in late 2024. By May 2025, the firm had introduced stablecoin-powered financial accounts in over 100 countries, particularly targeting markets affected by currency instability, such as Argentina, Turkey, and Colombia. Industry strategists noted that the latest platform extends beyond payments, serving as foundational infrastructure for a broader tokenized economy in which major corporations could issue their own currencies.

Regulatory clarity and market momentum

The global regulatory landscape for stablecoins has been evolving rapidly, and Stripe has embedded compliance tools within Open Issuance to meet requirements across jurisdictions. Analysts suggested that this move could drive wider adoption among corporations that are traditionally cautious about entering the crypto sector.

The broader market reaction has been positive, with Stripe’s private valuation reportedly climbing after the announcement. Competing firms are expected to follow with similar solutions, likely triggering a new round of investment in blockchain-based financial infrastructure.

Outlook for corporate-issued stablecoins

The stablecoin market has expanded by more than 300% since 2022, largely fueled by institutional adoption. Stripe’s new platform is expected to accelerate this trajectory by lowering barriers for corporate participation. Industry watchers believe Open Issuance could reshape approaches to treasury management, international payments, and even customer engagement. Reports indicate that retail chains are already considering branded stablecoins for loyalty and payment programs.

With this launch, Stripe has taken its boldest step yet into digital finance. Open Issuance has the potential to reposition the company from a payment processor into a core infrastructure provider for the emerging era of corporate digital currencies.