BTC plunged to its lowest point since July 13, but evidence indicates that professional traders are wary of a swift rebound. Bitcoin (BTC) fell from $19,820 to $18,960 in just two hours on September 6 due to an unexpected $860 pullback. The fluctuation forced derivatives markets to liquidate Bitcoin futures contracts worth $74 million, the biggest in over three weeks. The spot value of $18,711 is the lowest price level since July 13 and represents a fall of 24% from the surge to $25,000 on August 15th.

BTC plunged to its lowest point since July 13, but evidence indicates that professional traders are wary of a swift rebound. Bitcoin (BTC) fell from $19,820 to $18,960 in just two hours on September 6 due to an unexpected $860 pullback. The fluctuation forced derivatives markets to liquidate Bitcoin futures contracts worth $74 million, the biggest in over three weeks. The spot value of $18,711 is the lowest price level since July 13 and represents a fall of 24% from the surge to $25,000 on August 15th.

It is important to note that a 2% push toward $20,200 occurred in the initial hours of September 6; however, the movement was soon tempered, and Bitcoin restarted trading around $19,800 within an hour. In the 48 hours before the market reversal, Ether’s (ETH) price behavior was more intriguing, rising by 7%. Ether fell 5.6% on September 6, compared to Bitcoin’s $860 decline, which represents a 3.8% move. This disproves any notions that investors are shifting their stance to support the cryptocurrency.

The industry has been in a sort of slump since Jerome Powell’s remarks on August 27 were accompanied by a $1.25 trillion erosion in the value of the US stocks in a single day. Powell said at the annual Jackson Hole Economic Symposium that greater interest rate rises remained a distinct possibility, forcing the S&P 500 to finish 3.4% lower that day.

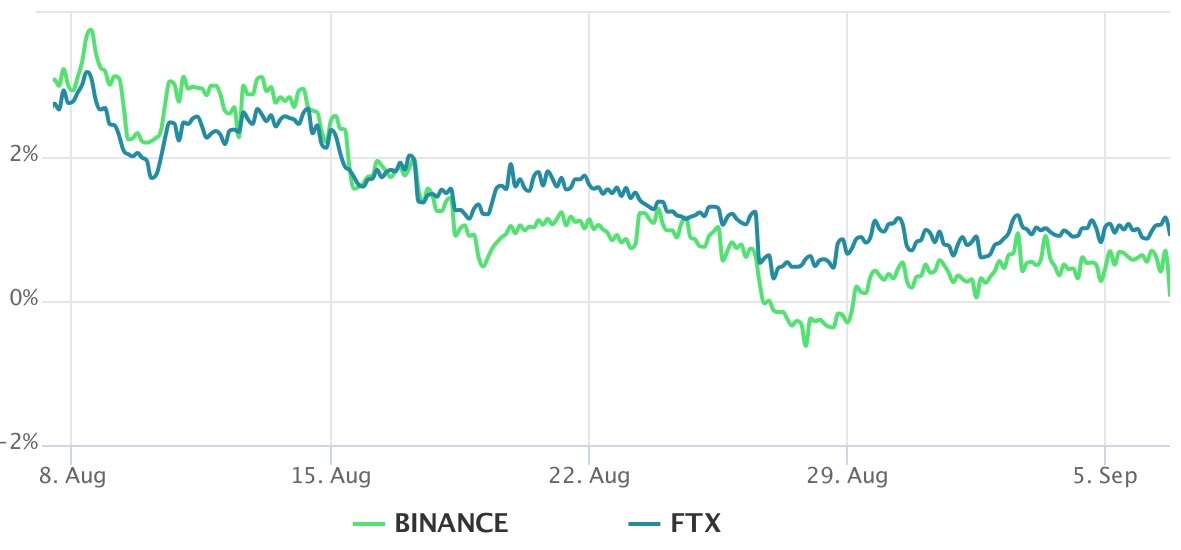

Let’s examine crypto derivatives numbers to see if investors have already been factoring in greater probabilities of a market decline. Quarterly futures are often avoided by retail traders because their prices fluctuate significantly from spot markets. Nonetheless, they are the favored assets of expert traders since they limit the change of financing rates that frequently happens with perpetual futures contracts.

In strong markets, the gauge should move at a premium of 4% to 8% annually to account for related financial risks and costs. Therefore, it is fair to assume that derivatives traders were neutral to negative throughout the last month, given the Bitcoin futures premium stayed below 3% throughout. This information indicates that experienced traders are hesitant to initiate leveraged long (bull) bets.

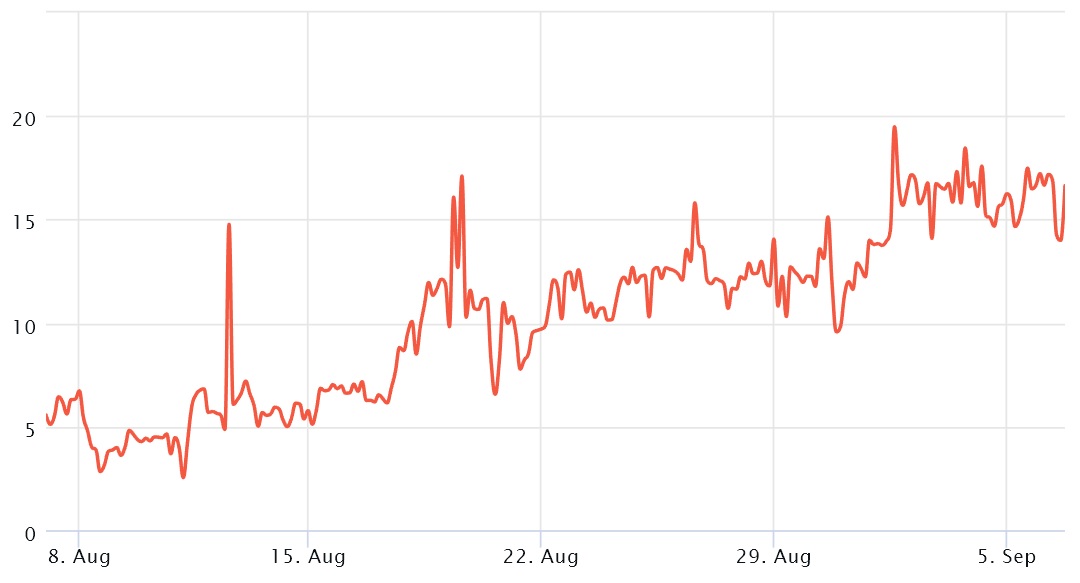

Additionally, one needs evaluate the Bitcoin options markets in order to eliminate futures-specific externalities. For instance, a 25% delta skew indicates that market makers and arbitrage trading desks are pricing excessively for upside or downside security. In bad markets, options traders increase the probability of a price decline, leading the skew indicator to soar over 12 percent. Conversely, optimistic markets have a tendency to push the skew indicator under -12%, indicating that bearish put options are undervalued.

Since September 1, the 30-day delta skew has been over the 12% threshold, indicating that options traders are less likely to give downside protection. These two derivatives metrics imply that the Bitcoin price drop on September 6 may have been partly anticipated, which clarifies the negligible effect on liquidations.

In contrast, the Bitcoin price decline of $2,500 on August 18 led to $210 million in leveraged long (buyer) closings. Nonetheless, the prevalent bearish investor sentiment doesn’t really necessitate negative price action. When whales and market makers are less likely to provide leverage to long positions and give downside protection via options, one should proceed with caution.