Cryptocurrency focused fund Grayscale Investments has revealed that it now possesses over 500,000 Bitcoins in Bitcoin Trust, which is one of the crypto funds administered by the institution.

Cryptocurrency focused fund Grayscale Investments has revealed that it now possesses over 500,000 Bitcoins in Bitcoin Trust, which is one of the crypto funds administered by the institution.

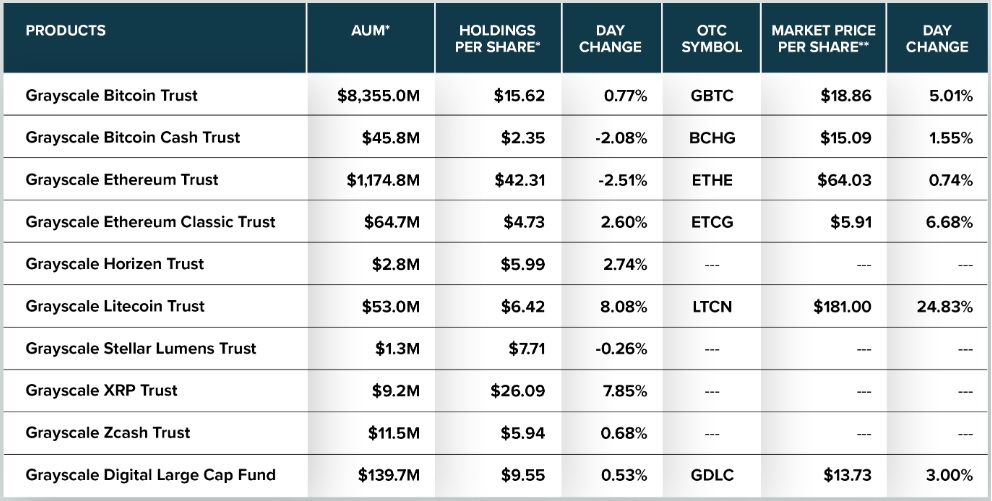

As per a post made on November 16, Grayscale now owns $8.35 billion worth Bitcoin, representing 2.69% of Bitcoin’s (BTC) outstanding supply.

Chainalysis, which provides crypto related data, has assessed that roughly 3.70 million Bitcoin have vanished or cannot be retrieved, implying that Grayscale’s holding represents 3.37% of Bitcoin’s leftover prevalent supply.

Each unit representing Bitcoin Trust is worth $15.62, while being traded at $18.86, reflecting a premium of 19% or $3.24. Yet, institutional investors are ready to purchase it through Grayscale, a regulated institution. Grayscale also slaps a yearly fee of 2%.

Grayscale Bitcoin Trust now holds more than 500,000 $BTC. Yes, you read that right. Learn more about the world’s largest #Bitcoin investment product. #GoGrayscale https://t.co/2sEpUdw8iN pic.twitter.com/9h8nGZ8i4t

— Grayscale (@Grayscale) November 16, 2020

The Grayscale Bitcoin Trust has vigorously bought Bitcoin this year, with the quantum of BTC possessed by the fund rising roughly 50% in the last six months. That’s a stupendous growth for a fund that was established just seven years back and reflects increasing interest of institutions.

A week before, the fund announced its largest intake of 15,907 Bitcoins worth about $215 million. Grayscale’s another fund, Ethereum Trust, also stepped up its buying this year and now possesses about $1.175 billion worth Ether (ETH) or 2.24% of the crypto’s aggregate market cap.

Grayscale’s eight more cryptocurrency funds presently administer roughly $400 million worth assets, taking the aggregate value of digital assets administered by the company to $9.90 billion.