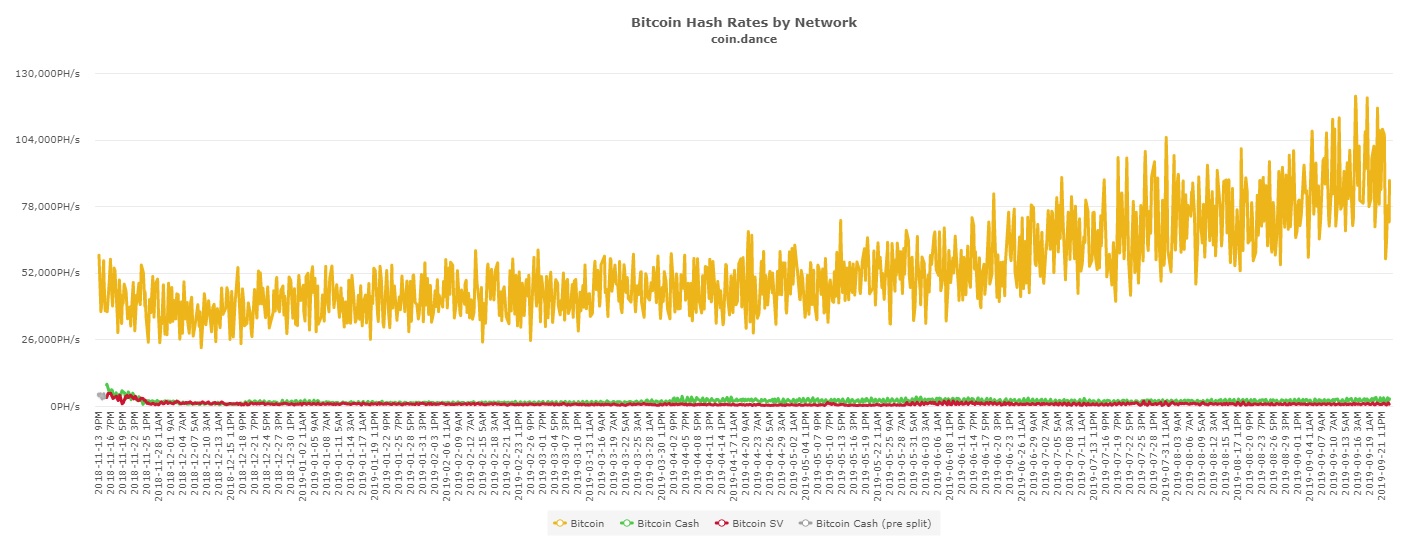

Bitcoin (BTC), which lost nearly 8% of its value yesterday, surprised market with a 40% dip in network hash rate. As per data provided by Coin.dance, the network’s hash rate plunged to 57,700,000 TH/s, from 98,000,000 TH/S.

Bitcoin (BTC), which lost nearly 8% of its value yesterday, surprised market with a 40% dip in network hash rate. As per data provided by Coin.dance, the network’s hash rate plunged to 57,700,000 TH/s, from 98,000,000 TH/S.

The flash crash is yet to be explained by crypto experts. The decline in network hash rate is surprising considering the recent price rise of Bitcoin and corresponding increase in hash rates which regularly broke records.

Only five days before, Bitcoin’s hash rate surpassed 102 quintillion hashes and set a new record. The hash rate of a crypto, sometimes highlighted as hashing or computing power, is a measure of the number of calculations that a network can carry out per second.

A higher hash rate indicates strong competition among miners to solve new blocks. An increase in hash rate also ensures more safety to the blockchain as huge resources will be required to carry out a 51% attack.

At the time of writing this article, Bitcoin’s hash rate has recovered to 88,300,000 TH/s, but still below its previous records.

All through summer, cryptocurrency analysts had asserted that the network’s record breaking series of hash rate highs was a bullish signal for the numero uno cryptocurrency’s performance.

Bitcoin investor Max Keiser, through a tweet, has pointed out that: “Price follows hashrate and hashrate chart continues its 9 yr bull market.”

Two years back, Bitcoin saw a similar incident of 50% decline in hash rate, in addition to a slowdown in processing time and price decline. At that time, some miners switched over to the forked network that resulted in the creation of Bitcoin Cash (BCH). However, many of the miners have returned back to Bitcoin mining.