Traders use the phrase Red September because September has been Bitcoin’s softest month on average. Since 2013, Bitcoin’s mean September has been negative, and it has closed down in most Septembers. On September 4, 2017, Chinese authorities banned initial coin offerings. Days later, Chinese regulators told domestic exchanges to halt trading and new registrations. Bitcoin went below $3,000 during the mid-month due to high FUD, after starting September near record highs.

On September 24, 2021, China’s central bank and top agencies declared all crypto transactions illegal and decided to go after mining and block offshore platforms from serving mainland users. Bitcoin dropped by roughly 9% in a single day before showing a minor pullback. The altcoins followed the price action. However, the last two Septembers have been bullish, pushing Bitcoin 3.9% and 7.29% during 2023 and 2024, respectively. September 2024 was bullish for Bitcoin for three clear reasons. First, the Federal Reserve cut rates by 50 basis points on September 18, which caused financial conditions favorable for Bitcoin.

Second, the U.S. spot Bitcoin ETFs approval was a major move, which brought large cumulative inflows through 2024 that kept demand higher. Third, the April 2024 halving reduced new issuance, so the market faced less sell pressure and the price responded quickly to any shift in demand.

This is September 2025, and the regulations are in favor of crypto more than ever. Therefore, bulls are expecting a Green September and a bullish trend continuation.

Bitcoin Monthly Returns

| Year | September | October | November |

|---|---|---|---|

| 2024 | 7.29% | 10.76% | 37.29% |

| 2023 | 3.91% | 28.52% | 8.81% |

| 2022 | -3.12% | 5.56% | -16.23% |

| 2021 | -7.03% | 39.93% | -7.11% |

| 2020 | -7.51% | 27.70% | 42.95% |

| 2019 | -13.38% | 10.17% | -17.27% |

| 2018 | -5.58% | -3.83% | -36.57% |

| 2017 | -7.44% | 47.81% | 53.48% |

| 2016 | 6.04% | 14.71% | 5.42% |

| 2015 | 2.35% | 33.49% | 19.27% |

| 2014 | -19.01% | -12.95% | 12.82% |

| 2013 | -1.76% | 60.79% | 49.35% |

| Average | -3.77% | 21.89% | 46.02% |

Why Red September Happens?

Stocks, crypto, and forex – all need each other for liquidity as it keeps flowing across the multiple markets. The history shows that the month of September is historically the weakest month for the S&P 500 on average. It is a pattern.

But the question is, why is September so bearish?

Portfolio managers return from summer and reset exposures for year-end reports. Many mutual funds face fiscal year-ends close to September, so they clean up holdings, which adds selling pressure. Rebalancing after big summer moves reduces equity weights. Psychology plays a role as well, because investors expect unpredictable markets and act more cautiously. This all adds up to make September bears’ friendly month.

Why this September may be bearish

The Bitcoin price has been closing negatively due to financial rebalancing during this month. Quarter-end rebalancing arrives in the final week of September. After a strong summer for equities, many pension and multi-asset funds cut risk to restore target weights. They are expected to sell stocks and raise bonds or cash. When equities go bearish, crypto often follows the move because traders reduce leverage. Spot Bitcoin ETFs can see outflows as advisors rebalance client accounts, which forces market makers to redeem shares and sell BTC. Liquidity is thinner late in the month, spreads also increase, and small dips trigger stop losses. There will be additional selling pressure on the crypto market from Ethereum ETFs for the same reasons. This might start a cascade of bearish moves, closing Bitcoin negative.

Currently, the Bitcoin price is above $112,000, already 4% up in the first 4 days. The price of Ethereum has been bullish since it broke above $4,000 resistance. The bigger whales have been rotating their assets between Bitcoin and Ethereum and pumping either of these assets while the other one awaits.

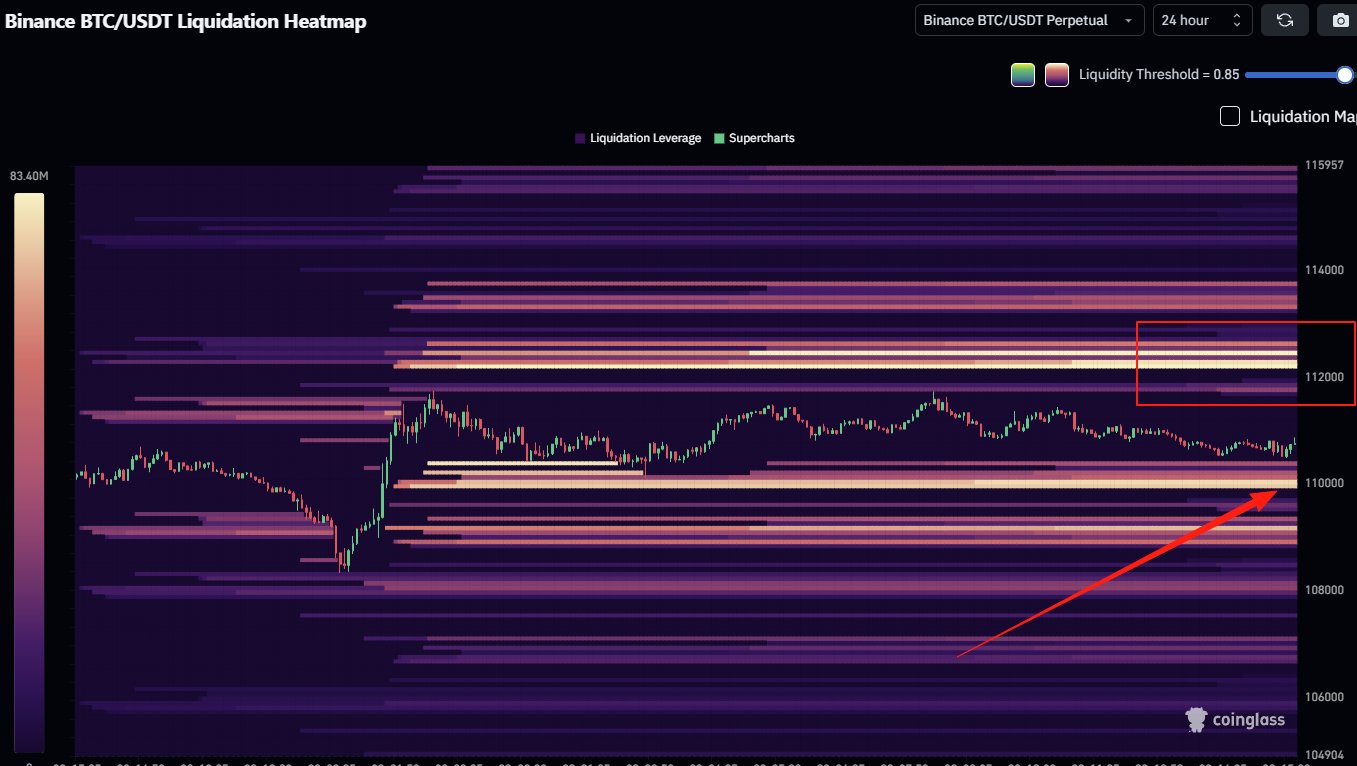

If Bitcoin liquidity rotates to Ethereum, the volatility fades out, and the day traders would shift to more volatile assets. Also, there are over $70 million long positions on the Binance exchange alone, which will be liquidated if the Bitcoin price drops to $110300, according to CoinGlass data. The exchanges would definitely try to revisit these levels before the price could stabilize. Due to these two major reasons, the analysts predict the price of Bitcoin to turn negative again after 2 consecutive positive Septembers. Unless fresh inflows overpower quarter-end rebalancing and the rotation into Ethereum, September is expected to close the month in the red.