Solana price has been struggling to maintain above $200 mark even during the bullish wave, but the new developments may push it higher. The price of Bitcoin is rising again after touching $108,600 levels. The price of Bitcoin is 5% up during this week and around 9% up in the last 30 days. Bears were expecting the price to close in red during September, however, the green candles have instilled a fresh flow to Bitcoin and the entire crypto market. The current bullish wave is being followed by altcoins, including Solana. The price of Solana has been trading between $225 and $191 during the last week.

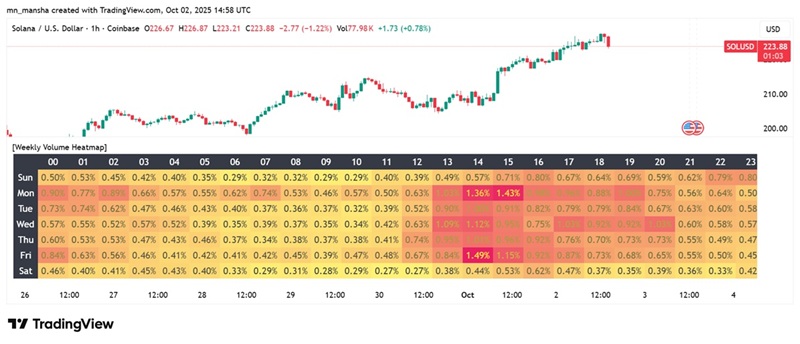

The price action has been showing strength earlier in the week, but recent candles show slight exhaustion. The weekly volume heatmap shows concentrated activity on Mondays and Wednesdays, particularly during the 14:00 to 16:00 UTC window, where volumes peaked above 1.4%. On the other hand, weekend sessions show a bit weaker participation, with hourly volumes mostly under 0.5%. This pattern suggests institutional preference for weekday sessions, where weekends have the minimum activities.

During the last week, between September 21st and 27th, the price of Solana dropped by 14%. Solana, while up 6% during the last 7 days, had been trailing most other major cryptocurrencies in 2025, which actively contributes to a lack of investor confidence in the long run.

$291 Million Institutional Money Flows Into Solana

Solana gets $291 million in institutional investment this week, which ultimately created positive sentiments and investors’ confidence. That influx exceeded comparable flows into Ethereum over the same period, reflecting a shift in capital toward Solana’s ecosystem.

Solana recorded $125.4 billion in spot DEX volume during September, surpassing Ethereum’s $109.7 billion and Binance Smart Chain’s $90.8 billion. This is another confirmation that Solana is growing as the preferred venue for on-chain trading.

With such dominance in decentralized exchange activity, the recent wave of institutional funding matches with the real market traction and strengthens the case for higher price targets in the months ahead. If these funds continue arriving, they could fuel a sustained push above the $250 resistance and lay the groundwork for a test of $300.

Solana to Cross $300 This Month?

Between August 1st and September 25, Solana price kept rising on a bullish trend line, until it touched $241. The price of Solana underwent a major price correction and reached $191 during the last week. The price is again showing the signs of recovery and again rising to a similar trendline, which now acts as a resistance.

If Solana manages to break through the $241 resistance, momentum could extend toward the $253 zone, where sell-off pressure had previously emerged. A rejection at this level may trigger another retracement toward $193, which acted as support during the last correction. The current rebound means fresh buying interest, but the price still faces a decisive test along the broken trendline, now turned into resistance. This trendline would determine whether Solana continues its path toward higher targets or consolidates further.

With the current price lower than $230, it may take Solana another day or two to reach the local high of $241. Solana is expected to show a correction due to the high pressure at the top. It will take around a week for Solana to overcome this correction and consolidate to make a good ground for an upward trajectory. Solana may still struggle to reach $300 in October, a bullish month by historical price actions, as the correction and consolidation phase could limit upside momentum within the month.