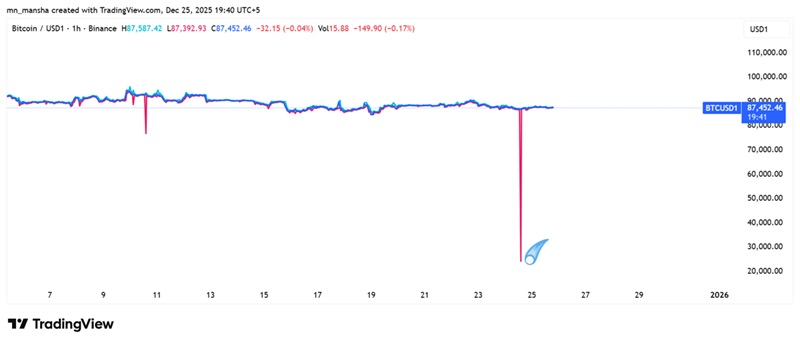

Leveraged crypto positions are risky, and slight price movements are chaotic for the traders. Bitcoin has been showing insane volatility, but recently, in a flash crash, the price dramatically dropped to $24,000 on the Binance crypto exchange. The move was followed by a quick recovery, back to $87,000.

The insane, volatile move was limited to a newly established trading pair, BTC/USD1. Though we still don’t have any official explanation for this drop, the event is being reported as a microstructure event caused by thin holiday liquidity (low trading volume on Christmas), possibly amplified by a large order or order book anomaly.

This was a flash move, so it took less than a minute. Nevertheless, a price drop of the largest crypto asset by 70% within a minute nearly caused FUD among the traders. This “wick” on the chart appears as a vertical line of extreme variance, which represents a potentially life-altering opportunity for the automated trading bots or lucky individuals who managed to execute buy orders at the $24,000 bottom or near that area. However, the leveraged positions opposite to this move were likely exposed to catastrophic liquidations. Binance’s new listings are often profitable, but this one turned out to be a disaster.

USD1: The Reason Behind Flash Crash

The flash wick drop of the BTC/USD1 pair put USD1 in the spotlight, though it was not for a good reason. USD1 is a dollar-pegged stablecoin issued by World Liberty Financial, a project linked to the Trump family. The coin has secured a market cap of over $3 billion with 541k holders. Binance recently listed USD1 and aggressively promoted the coin through incentives like 20% APY on the USD1 deposits.

USD1 is new in the market and definitely not battle-tested like USDT or USDC coins. The market liquidity was already shallow due to low trade volume during the Christmas holidays. In such a situation, when a large market sell order hit the shallow order book, it created an extreme, rarely seen dislocation, a classic symptom of immature pairs. This event was the first stress test for the USD1 integration and peg stability, which apparently failed.

However, some of the experts don’t see it that way. However, they deem it a shady move to do business by manipulating the price of a newly launched, poorly liquidated pair.

For USD1, this incident is a challenge to build trust and depth as a newcomer, particularly when large institutional flows intersect with promotional campaigns. As the stablecoin stabilizes with input from inflows, its long-term viability is being questioned. Such anomalies scare away the investors and traders in a market where we have already seen examples like the USTC stablecoin.

Looking Ahead

Ethereum, Bitcoin prices, and the overall crypto market remain intact from the flash drop of the Bitcoin pair on Binance. The Christmas flash crash of Bitcoin price is an actionable lesson to all traders, market makers, and investors. Market structure, liquidity, and credibility of a pair are the most important factors while trading, particularly in leverage trading. The traders must prioritize due diligence over the hyped marketing and quick gains. Not all trading pairs, even in stablecoins, are equal. Always check the underlying liquidity and trading volume before placing significant capital.

The future of crypto trading, therefore, will be defined by risk management. Will you rely on automated systems to catch the next extreme “wick,” or will you hedge your bets? The answer to this question will determine whether you survive the next liquidity trap or become another liquidation statistic.