Ripple is preparing to introduce its RLUSD stablecoin across the European Economic Area (EEA) by leveraging Luxembourg’s financial infrastructure and regulatory environment. As part of this initiative, the company has reportedly submitted an application for an electronic money institution (EMI) license in Luxembourg, a move that would enable operations throughout all 30 EEA member states under the European Union’s Markets in Crypto-Assets (MiCA) regulations.

Building a Foundation for EU Expansion

To support its licensing efforts, Ripple established Ripple Payments Europe SA in Luxembourg in April. The new entity is intended to serve as a regional base for navigating EU compliance obligations. Among the appointed administrators are senior personnel from the UK, including Chris Myers, who holds the role of Senior Counsel for Ripple’s EMEA operations. Myers is expected to oversee the licensing process with Luxembourg’s Commission de Surveillance du Secteur Financier (CSSF), the country’s primary financial regulator.

In parallel with its regulatory application, Ripple has been expanding its talent pool to support the RLUSD rollout. Although headquartered in San Francisco, the firm has advertised new roles in Toronto, Geneva, and Luxembourg, signaling a global approach to product development and compliance. Noteworthy job listings include positions for anti-money laundering and compliance professionals, as well as a product controller specifically focused on payments and stablecoins in Luxembourg.

Strategic Advantages of Luxembourg

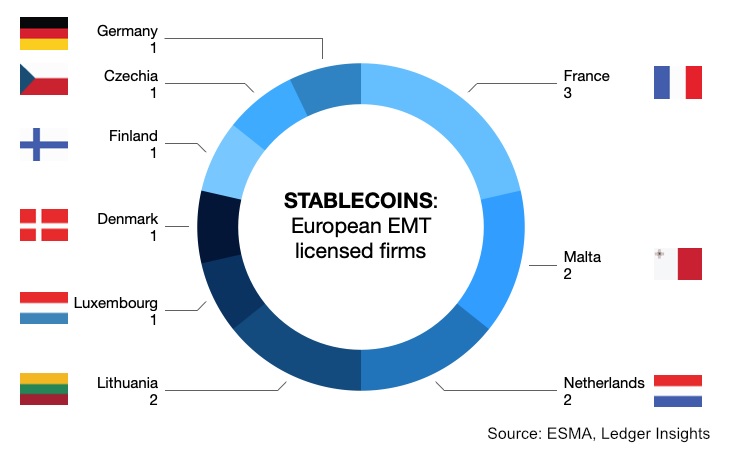

Despite currently hosting just one other stablecoin issuer—Banking Circle—Luxembourg presents significant strategic benefits for Ripple. The country is a prominent financial hub where major global banking institutions, including Ripple’s custody partner BNY, maintain a local presence. This well-established banking infrastructure facilitates the connectivity needed to comply with the reserve and diversification requirements imposed by MiCA regulations.

Under the new EU framework, stablecoin issuers are required to hold substantial reserves in traditional financial institutions—30% for smaller operations and up to 60% for larger ones. Moreover, regulatory limits stipulate that no more than 5% to 15% of reserves can be held with a single bank, with an allowance of up to 25% for systemically important institutions. Luxembourg’s broad banking ecosystem is expected to make adherence to these rules more achievable by offering a wider range of eligible counterparties.

Competing Across Europe’s Financial Centers

Although France currently leads the EMI licensing landscape within the EU—benefiting from its status as host to four global systemically important banks—Luxembourg compensates by serving as a financial base for most major international institutions. Countries like Germany, the Netherlands, and Spain each host only one such bank, giving Luxembourg a comparative advantage in terms of operational flexibility and compliance options.

Ripple’s approach aligns with its stated ambition to become a key player in global payments infrastructure. The RLUSD stablecoin, backed by traditional financial reserves and blockchain transparency, is central to that strategy. By positioning Luxembourg as its European regulatory gateway, Ripple appears to be preparing a stablecoin launch that meets both regional compliance standards and institutional requirements.

As MiCA regulations shape the future of digital assets in the EU, Ripple’s efforts to secure an EMI license signal its commitment to long-term, compliant growth across European markets.