Tether, the largest digital asset company globally, has unveiled plans to deploy its USDT stablecoin on RGB, a next-generation protocol for issuing digital assets directly on Bitcoin. The initiative highlights an effort to enhance Bitcoin’s role beyond its function as a store of value by enabling stablecoins to operate natively on its blockchain.

RGB, which recently went live on mainnet with its 0.11.1 release, has been developed to provide private, scalable, and user-controlled issuance of assets. Through this integration, USDT will be able to operate directly on Bitcoin’s infrastructure, giving users the option to hold and transfer both Bitcoin and stablecoins within the same wallet. The model is expected to deliver fast, private, and lightweight payments while leveraging Bitcoin’s security.

Stablecoin integration into the Bitcoin ecosystem

Tether explained that by bringing USDT onto RGB, it is unlocking new possibilities for stable digital money within the Bitcoin ecosystem. The arrangement is designed to allow users to conduct sovereign transactions, hold stablecoins alongside their Bitcoin, and even send and receive value offline. This combination of Bitcoin’s decentralization and Tether’s price stability is being presented as a significant advancement toward making stablecoins a native part of the Bitcoin network.

The company also highlighted that the launch would enable advanced features such as offline transactions, enhancing flexibility and resilience in payment environments. Industry observers have noted that this expansion reflects Tether’s ongoing strategy of increasing stablecoin adoption across multiple blockchain ecosystems.

Paolo Ardoino, the Chief Executive Officer of Tether, emphasized that Bitcoin required a stablecoin that felt native, lightweight, private, and scalable. He noted that RGB created a new pathway for USDT on Bitcoin, reinforcing the company’s belief in the cryptocurrency as the foundation for a more open financial future.

Tether to Launch USD₮ on RGB, Expanding Native Bitcoin Stablecoin Supporthttps://t.co/pige2t9Cc3

— Tether (@Tether_to) August 28, 2025

Strengthening Tether’s market position

The announcement underlines Tether’s leadership role in the stablecoin market, where it continues to broaden the reach of its flagship product. By enabling USDT to function seamlessly within Bitcoin’s infrastructure, the company is ensuring that the original cryptocurrency remains relevant as a backbone for decentralized finance and everyday transactions.

Tether supports the evolution of Bitcoin-native stablecoins—exploring RGB and Taproot Assets—to bring USD₮ home.

Because freedom should move on Bitcoin.⚡https://t.co/VPqE4TvCpq pic.twitter.com/q5stVZjXKj— Tether (@Tether_to) August 28, 2025

The move also aligns with Tether’s broader expansion efforts. Earlier this month, the company acquired a minority stake in Bit2Me, a Spanish crypto platform, as part of a strategic investment. Alongside this acquisition, Tether is leading a €30 million (approximately $35 million) funding round aimed at supporting Bit2Me’s growth across Europe and Latin America. The deal is expected to close in the coming weeks.

Stablecoin market trends show cooling growth

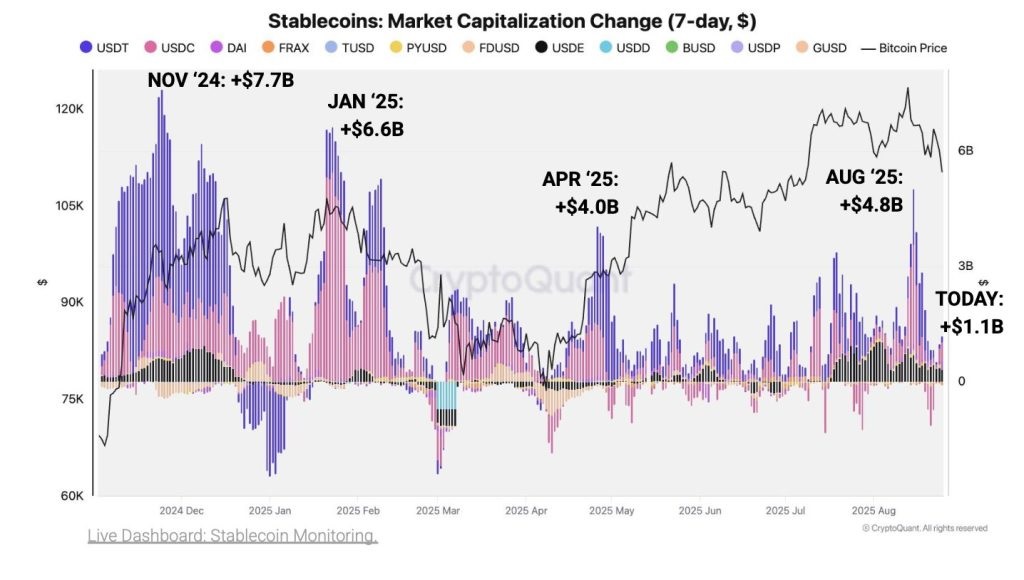

Recent data from CryptoQuant suggests that while stablecoin liquidity continues to expand, the pace of growth has slowed significantly. Weekly increases in stablecoin market capitalization now stand at around $1.1 billion, compared with the $4–8 billion weekly inflows recorded in late 2024. These earlier inflows played a critical role in fueling Bitcoin’s strong upward momentum at the time.

Tether’s USDT remains dominant in the sector, although its 60-day growth has moderated. Current figures indicate that inflows are holding near $10 billion, compared with peaks above $21 billion earlier in the market cycle. Although still positive, the reduced momentum points to a cooling trend in capital moving into stablecoins.

Toward a native stablecoin era on Bitcoin

With the integration of USDT on RGB, Tether is attempting to reshape how stablecoins interact with Bitcoin. The initiative combines blockchain innovation with stable monetary value, presenting Bitcoin as more than just a reserve asset. By aligning scalability, privacy, and interoperability, Tether is advancing its vision of a future where Bitcoin serves not only as a store of value but also as the foundation for global digital payments.