The blockchain staking sector has crossed the $300 billion mark in market value, solidifying its place as a major yield-generating avenue within the global financial ecosystem. Industry observers suggest that this development could significantly influence how sovereign wealth funds (SWFs) secure and distribute national prosperity in the digital age.

Analysts at Real Vision, including former Bloomberg Intelligence researcher Jamie Coutts, have assessed that sovereign funds may increasingly view Bitcoin and associated industries such as mining as essential holdings. In their view, these digital assets may go beyond serving as mere stores of value. They could become crucial infrastructure components, potentially assisting with energy grid optimization and supporting the balance of power consumption driven by artificial intelligence systems.

From oil royalties to digital yield

Coutts drew parallels between the role of oil royalties in the 20th century and the potential of blockchain staking yields in the 21st century. Historically, resource-based royalties funded large-scale national projects and underpinned welfare programs. The modern equivalent, according to his analysis, may come not from fossil fuel extraction but from token-based economies where staking operations generate continuous yield.

This perspective suggests that sovereign wealth funds might not only accumulate cryptocurrencies like Bitcoin and Ethereum but also engage in direct staking activities at scale. The returns from these ventures could provide governments with a new income stream, which may eventually be redistributed to citizens. Coutts referred to this possibility as a sovereign digital dividend, a form of universal benefit tied to blockchain activity rather than traditional commodity wealth.

Counterbalance to AI disruption

A key factor highlighted in this analysis is the backdrop of rapid technological transformation, particularly artificial intelligence. With automation set to displace jobs across industries, blockchain yield could offer a stabilizing force for economies. Governments, by tapping into staking rewards, might secure a steady flow of resources to fund welfare systems, manage energy transitions, and strengthen economic resilience against volatility.

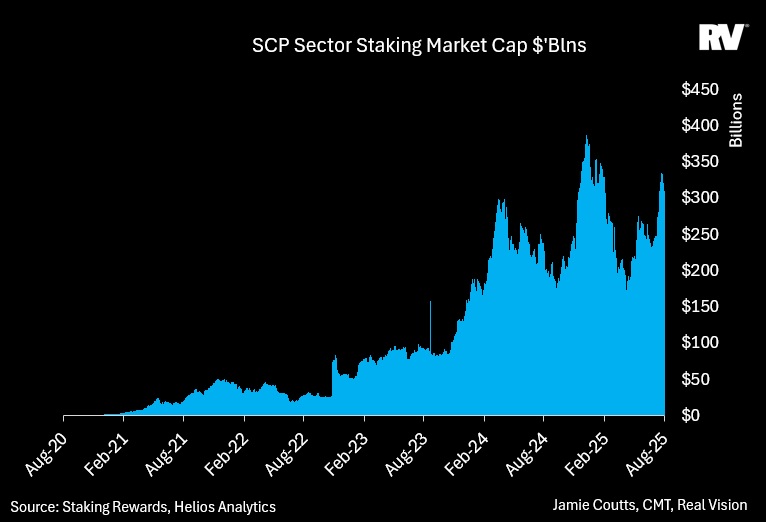

Data shared in support of this perspective points to the rapid expansion of staking since 2020. Capital inflows have steadily increased, with the sector’s base yield layer now surpassing $300 billion. While market cycles have caused fluctuations, the general upward trend has underscored growing institutional recognition of staking as a sustainable revenue model.

Redefining digital assets’ role

Bitcoin has long been positioned as digital gold, primarily serving as an inflation hedge and a reserve-like asset. Coutts’ interpretation expands this narrative by envisioning a future in which staking yields achieve a level of importance comparable to oil royalties of the past century. Should sovereign wealth funds embrace this approach, digital assets could evolve into both protectors of wealth and active income generators.

The potential impact of this shift is wide-ranging. National budgets might eventually rely on blockchain-generated income to support welfare programs, infrastructure, and technological innovation. In this framework, digital yield becomes not merely a by-product of decentralized finance but a foundational element of state-level prosperity strategies.

According to this analysis, just as oil anchored economic growth in the last century, blockchain staking yield could emerge as a defining resource for national wealth and stability in the digital-first 21st century.