BNB Chain has emerged as the most active network for stablecoin transactions, overtaking TRON and gaining a dominant share of decentralized exchange (DEX) volume, as outlined in ARK Invest’s latest DeFi Quarterly report. The analysis indicates that BNB Chain now accounts for nearly half of all DEX activity, largely due to increased trading volumes and the influence of Binance’s incentive programs.

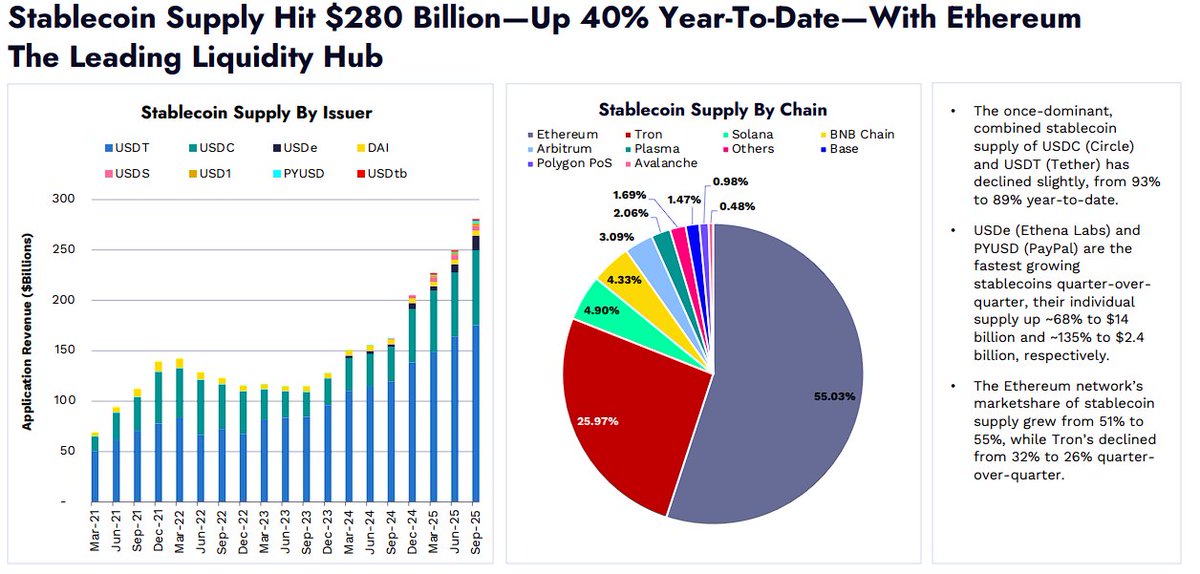

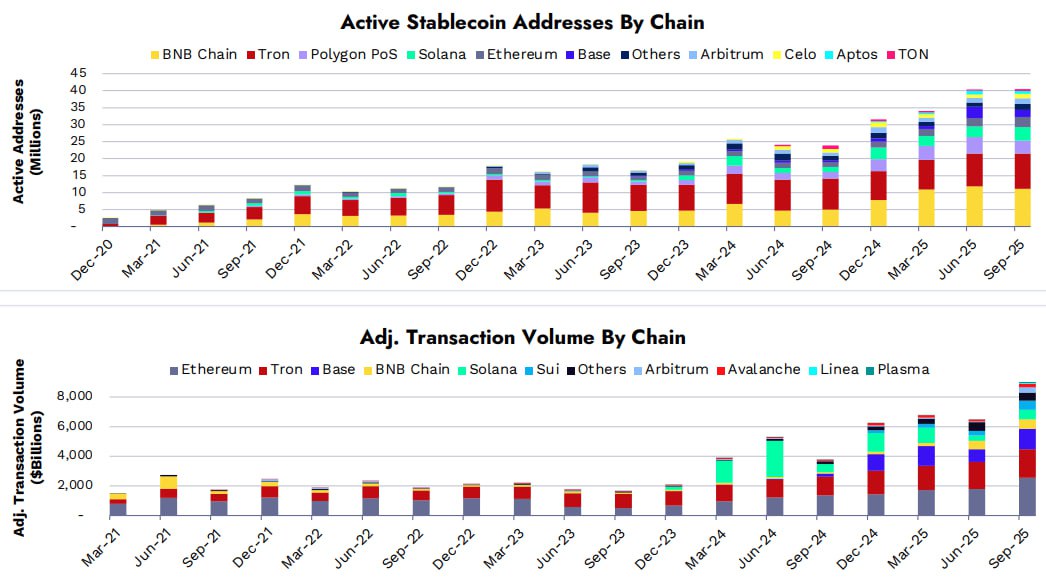

According to the report, the rise in stablecoin usage is part of a broader trend in the crypto sector, where more than 192 million addresses have interacted with stablecoins since their inception. Tether accounts for the majority of this usage, followed by the discontinued Binance USD and USD Coin. ARK’s findings further reveal that adjusted stablecoin transaction volumes have expanded by more than 40% so far this year, nearing the nine trillion dollar mark by the third quarter of 2025.

Market Share Shift Among Leading Networks

Ethereum remains the largest network when including its Layer 2 chains such as Base and Arbitrum, which collectively handle nearly half of all stablecoin transactions. TRON has historically sustained its relevance by facilitating USDT flows across emerging markets, but recent data shows a decline in its market share.

The report shows that Ethereum’s share of stablecoin supply has grown, while TRON’s has fallen noticeably. Meanwhile, BNB Chain has capitalized on shifting user behavior and market opportunities, absorbing a portion of the liquidity that moved away from other chains such as Solana.

Surge in DEX Volume Boosts BNB Chain

Decentralized trading activity has risen significantly, with total DEX volume climbing from about one trillion dollars to more than 1.7 trillion dollars since late 2024. During this period, Solana’s DEX market share dropped sharply, while BNB Chain’s share surged to 47%.

ARK Invest attributes this growth to Binance’s zero-fee trading initiative, which redirected retail and memecoin trading toward BNB Chain through PancakeSwap. The report adds that this shift created a more attractive environment for high-frequency trading and increased liquidity flow.

Data also shows that BNB Chain recorded the highest spot DEX activity relative to total value locked, reaching a ratio far beyond that of Ethereum. The analysts note that while Ethereum tends to attract long-term capital, BNB Chain has become a preferred venue for faster, speculative trading cycles.

Evolving Stablecoin Landscape and Market Fragmentation

The stablecoin market continues to diversify as newer entrants gain traction. Combined market share of USDT and USDC has declined slightly this year, while assets such as Ethena’s USDe and PayPal’s PYUSD experienced substantial growth, especially on Ethereum.

At the same time, on-chain trading is expanding relative to centralized exchanges, with the DEX-to-CEX ratio increasing by almost 200% this year. ARK’s report suggests that although Ethereum will likely remain the preferred settlement layer for institutional stablecoin flows, BNB Chain has secured a leading role in user participation and decentralized trading.

The research concludes that the crypto market is becoming increasingly fragmented, with liquidity spreading across multiple networks. This shift introduces new challenges in routing and interoperability but also allows individual chains to specialize based on user demand and technical strengths.