Patel Real Estate Holdings (PREH) has initiated a $100 million fund dedicated to tokenizing real estate assets on the Chintai blockchain. This move aims to expand access for accredited investors to high-quality, institutional-grade properties by leveraging the efficiency and transparency of blockchain technology.

The newly announced PREH Multifamily Fund focuses specifically on vintage Class A multifamily housing located in the top 20 growth markets across the United States. The initiative, revealed on May 12, forms part of a much broader investment effort valued at $750 million, which is being co-developed with several major institutional players. These include notable firms such as Carlyle, DRA Advisors, Walton Street Capital, RPM, and KKR.

PREH stated that the structure of this fund has been designed as fully digital from inception. This digital-native framework includes streamlined onboarding processes, investor reporting, capital call management, and options for secondary market transfers.

According to the firm, this blockchain-based approach addresses traditional hurdles faced by investors in private market placements. The tokenized structure is believed to enhance both transparency and liquidity, helping to overcome the limitations often associated with legacy investment formats.

Founded in 2010, PREH operates as a national real estate asset management company with a strong focus on Class A multifamily assets. The company is involved in all major aspects of real estate management, including acquisitions, financing, and ongoing property oversight. To date, PREH has executed over $500 million in real estate transactions.

Chintai, the blockchain chosen for this project, is a layer-1 protocol known for its focus on asset tokenization. In addition to the PREH partnership, Chintai also supports the R3 Sustainability Fund, which emphasizes environmental, social, and governance (ESG) investing principles. As of the latest data, Chintai’s native token, CHEX, holds a market valuation of $244 million with an individual token price of $0.24.

PREH’s leadership indicated that Chintai was selected due to its regulatory readiness and technical infrastructure specifically built for real-world asset tokenization. The platform’s emphasis on compliance and investor safeguards reportedly aligns with PREH’s objectives to introduce greater efficiency and accessibility while maintaining institutional standards.

Real estate tokenization has long been seen as a transformative force in the property investment sector, though real-world implementations had remained limited until recent years. However, by early 2025, such initiatives had started gaining substantial traction across markets in North America and the United Arab Emirates. European jurisdictions are also reportedly working on building regulatory support to accommodate similar growth.

The concept of eliminating the so-called illiquidity discount in real estate has emerged as a central argument in favor of tokenization. Analysts have suggested that the development of liquid secondary markets for fractionalized property ownership could significantly increase asset value and investor interest.

Reflecting this momentum, platforms like DigiShares have launched the REX marketplace on Polygon, showcasing tokenized luxury real estate in locations such as Miami. Meanwhile, other projects, including a collaboration between Blocksquare and Vera Capital, have moved toward offering fractional ownership across portfolios exceeding $1 billion in commercial real estate.

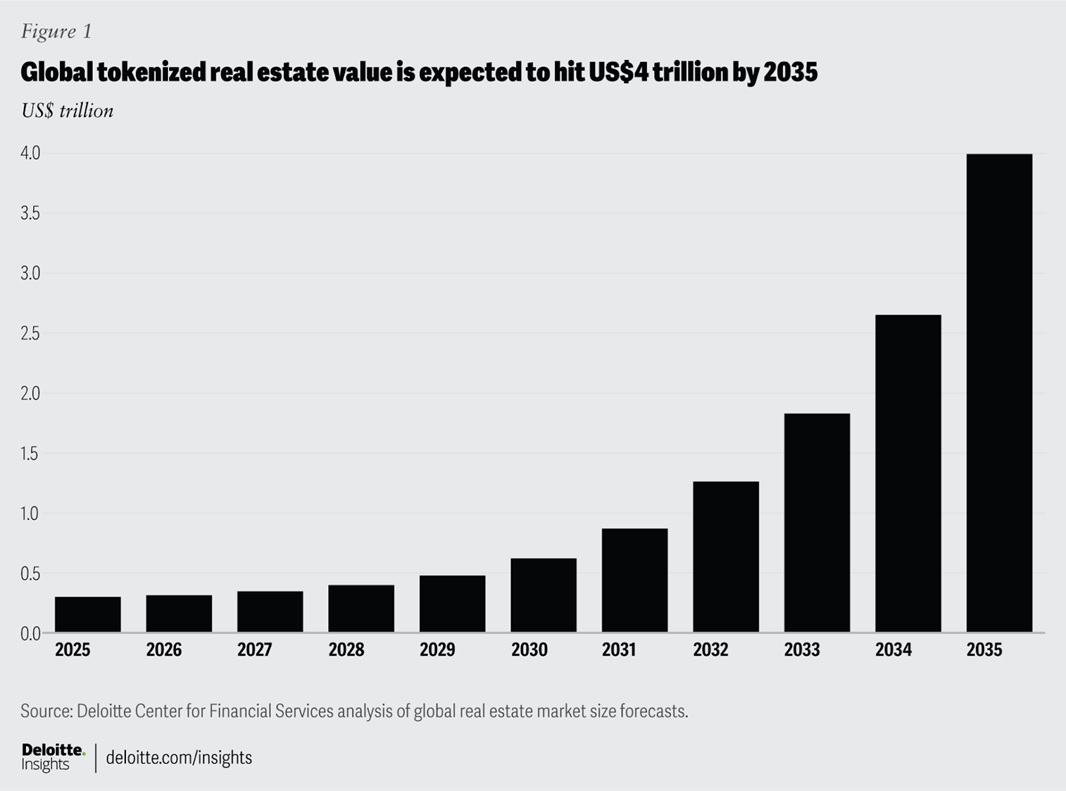

Forecasts from major consultancy firms point to sustained growth in this area. Deloitte has projected that real estate worth approximately $4 trillion could be tokenized over the next decade, indicating that the intersection of blockchain and property investment is entering a period of accelerated development.