Billions of dollars enter the cryptocurrency market each quarter, mainly due to the massive appeal of Bitcoin. Dozens of investment companies are showing institutional interest in not only Bitcoin but also in other altcoins. After passing Genius Bill by the US government and a government-owned cryptocurrency treasury, the crypto market is soaring to new highs.

MicroStrategy leads corporate treasuries with 601,550 BTC valued at about $71.4 billion, with over $28 billion in unrealized profit. Marathon Digital and Twenty One Capital follow with tens of thousands of Bitcoins in their treasuries. Public investment companies integrate Bitcoin into their strategies, they also set the stage for capital flows into promising tokens such as Ethereum, Solana, and SUI. Top 5 crypto investment firms are buying altcoins to boost their strategic reserve.

5 Crypto Investment Firms Secretly Investing Billions

Fresh capital keeps pouring into crypto. Spot‑asset funds booked a record $7 billion quarterly. Large inflows no longer stop at Bitcoin but mainly target the three altcoins: Ethereum, Solana, and Sui.

Ethereum Investments:

BlackRock and Fidelity lead in ETH strategic investments. Corporate buyers chase yield as well as liquidity. SharpLink Gaming added 4,951 ETH in July, pushing its holdings to 200,000 Ethereum coins and a market value near $1 billion.

This massive amount of Ethereum will be used as liquidity for the platform and as a strategic reserve. Bit Digital is also raising $162.9 million to scale its validator fleet and accumulate more ETH. Together, these moves shrink liquid supply and boost the staking economy to power most DeFi activity.

Solana Investments:

ETF demand jumped once U.S. regulators cleared futures‑based products. Listed companies move faster. Upexi secured $200 million in funding to raise its crypto reserve to 1.65 million SOL, about $270 million at current prices. It currently holds 1.819 million Solana coins worth $331 million.

DeFi Development Corp quietly accumulated 690,420 SOL worth $103 million, a 64% jump in two months. Such treasuries deepen staking pools and support Solana’s expanding dApp base.

Sui Investments:

Sui is a relatively new altcoin in this race. Grayscale’s SUI Trust recorded a 71.8% NAV surge over six months which outperformed Solana products. Canary Capital has already filed for the first spot SUI ETF, which signals confidence that regulators will green‑light broader access. Wormhole Bridge tracked $570 million in bridged inflows to Sui across a single 30‑day window, equal to 17% of all cross‑chain capital in that period.

According to CoinShares, Sui has pulled $72 million in year‑to‑date fund inflows, while Solana logged net outflows. These numbers clearly showcase a rotation toward newer layer‑1 projects like Sui.

These 5 crypto investment firms now control well over $8 billion across Ethereum, Solana, and Sui. Their allocations shrink supply, boost staking yields, and create liquid off-ramp conditions that often precede price increases.

What does this mean for Altcoins?

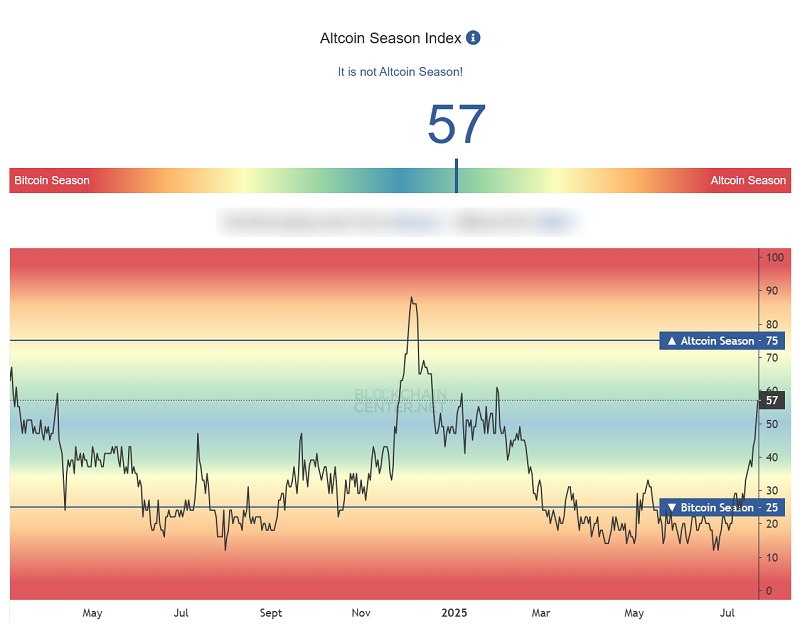

The Altcoin Season Index has climbed 147% in thirty days, a move that coincides with Bitcoin dominance sliding from 64% to about 61%. That actually frees market share for the rest of the field and offers a relatively level playing field to the altcoins.

Visibility matters. Tokens that sit in ETF prospectuses or corporate treasuries receive analyst coverage, derivatives listings, and deeper liquidity. Ethereum owns that spotlight, Solana has joined it through futures and multiple ETFs, and Sui is racing to catch up with a pending Canary Capital fund and eye‑catching NAV gains.

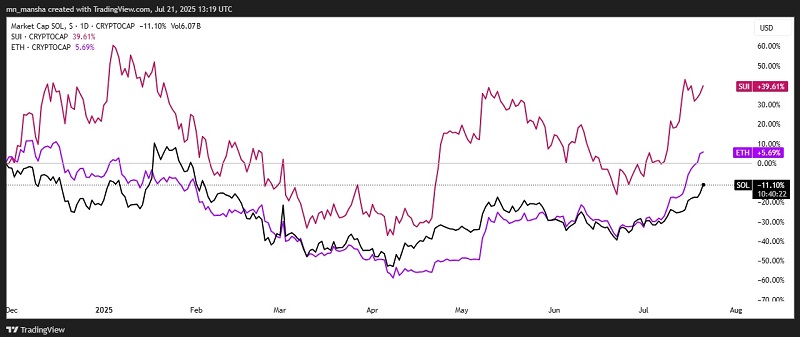

Year to date, SUI’s market cap is up about 39 percent, Ethereum shows a 5.7% climb, while Solana is behind with negative 11% progress. There is a clear difference in their performance, and this is because investors reward chains that pair high throughput with credible institutional demand and that punish networks when demand stalls, like it did in the case of Solana.

Altcoin season may not replace Bitcoin’s leadership, yet the current mix of falling dominance and rising specialist inflows hints that capital rotation has started. Expect coins backed by real utility, visible treasuries, and regulated investment products to capture the bulk of the next wave.